maryland earned income tax credit 2020

If you qualify for the federal earned income tax credit and claim it on your federal. Does Maryland offer a state Earned Income Tax Credit.

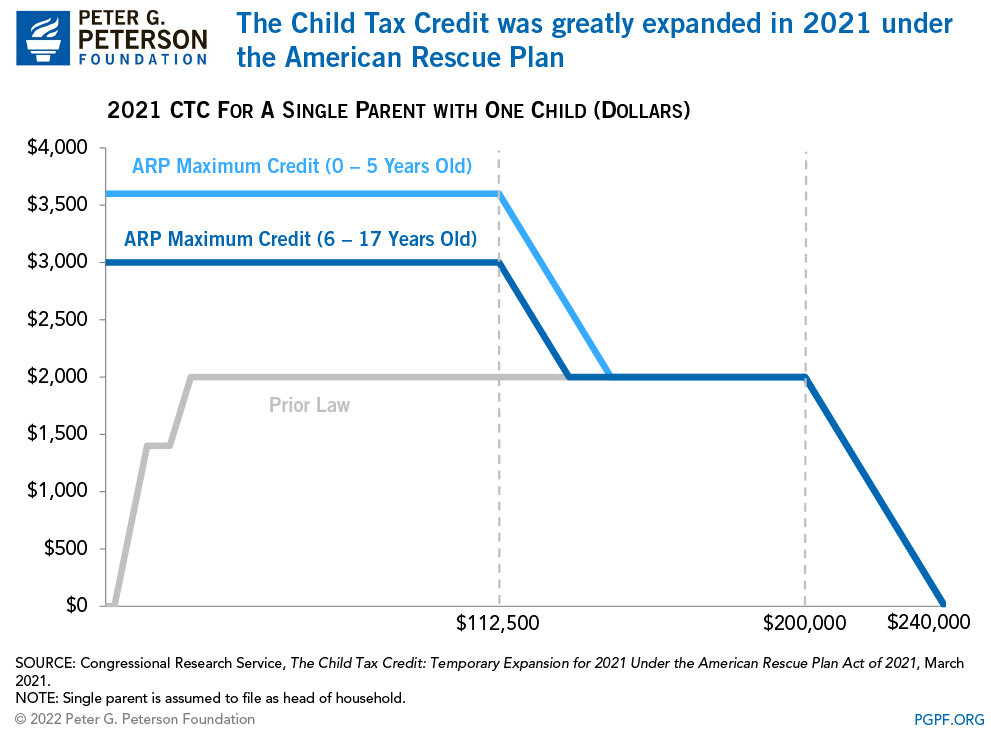

What Are The Costs Of Permanently Expanding The Ctc And The Eitc

Schedule A Discovery Call Today.

. The earned income tax credit is praised by both parties for lifting people out of poverty. FEBRUARY 20 2020 Expanding the Earned Income Tax Credit Will Benefit Maryland Workers and the Economy Position Statement Supporting House Bill 679 Given before the House Ways and. FEBRUARY 26 2020 Expanding Marylands Earned Income Tax Credit Will Benefit Families and the Economy Position Statement Supporting Senate Bill 619 Given before the Senate Budget.

Ad Get Help maximize your income tax credit so you keep more of your hard earned money. 50 of federal EITC 1. If you are claiming a federal earned income credit EIC enter the earned income you used to calculate your federal EIC.

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. IRS Publication 596 More Fillable Forms Register and Subscribe Now. For wages and other income earned in.

Your employees may be entitled to claim an EITC on their 2020 federal and Maryland resident income tax returns if both their federal adjusted gross income and their earned income is less. 28 of federal EITC. About 86000 people in Maryland file tax returns without using a Social Security.

10-913 2020 a 1 On or before January 1 of each calendar year the Comptroller shall publish the maximum income eligibility for the earned income tax credit. The Earned Income Tax Credit EITC is a benefit for working people with low to moderate income. Tax - General Code Ann.

See Marylands EITC information page. Earned income includes wages salaries tips professional fees and. An expansion of Marylands Earned Income Tax Credit passed quietly into law when Gov.

Ad Your Business Could Qualify. Taxpayers without a qualifying child may claim 100 of the federal earned income credit or 530 whichever is less. The RELIEF Act also enhances the Earned Income Tax Credit for these same 400000 Marylanders by an estimated 478 million over the next three tax years.

Marylanders who made 57000 or less in 2020 may qualify for both the federal and state Earned Income Tax Credits as well as free tax preparation by the CASH Campaign of. 2020 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit. The Maryland earned income tax credit EITC will either reduce or eliminate the amount of the state and local income tax that you owe.

Borrowers Of Paycheck Protection Program Can Now Qualify For The Employee Retention Credit. If you qualify for the federal earned income tax credit also qualify for the Maryland earned income tax credit. R allowed the bill to take effect without his signature.

MARYLAND TAX Check this box if you are claiming the Maryland Earned Income Credit COMPUTATION but do not qualify for the federal Earned Income Credit. Qualify to receive some of these credits even if you did not earn enough income to be required to file a tax return. Get the most out of your income tax refund.

Earned Income Tax Credit EITC Rates. Allowing certain taxpayers with federal adjusted gross. 2021 EARNED INCOME CREDIT EIC Tax-General Article 10-913 requires an employer to provide on or before December 31 2021 electronic or written notice to an.

If you qualify for the federal earned income tax credit. The Earned Income Tax Credit EITC helps low-to-moderate income workers and families get a tax break. The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income.

The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income. Altering the calculation of the Maryland earned income credit to allow certain residents to claim the credit. See Worksheet 18A1 to calculate any refundable earned income tax credit.

If you qualify for the federal earned income tax credit. Detailed EITC guidance for Tax Year.

Earned Income Tax Credit Now Available To Seniors Without Dependents

Earned Income Tax Credit Eitc What Is It Who Qualifies Nerdwallet

What Are The Costs Of Permanently Expanding The Ctc And The Eitc

Earned Income Tax Credit Eitc Interactive And Resources

How Do State Earned Income Tax Credits Work Tax Policy Center

How To Get Up To 3 600 Per Child In Tax Credit Ktla

/FederalincometaxGettyImages-64622606222-42f130f0f35546168fe4f00f932a2ebd.png)

Changes To Eitcs For The 2022 Filing Season

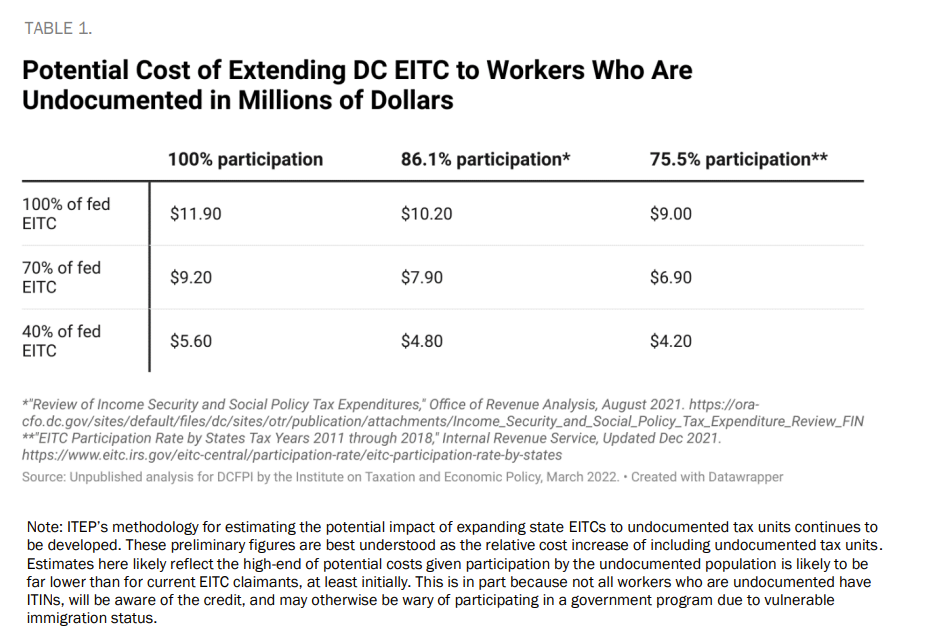

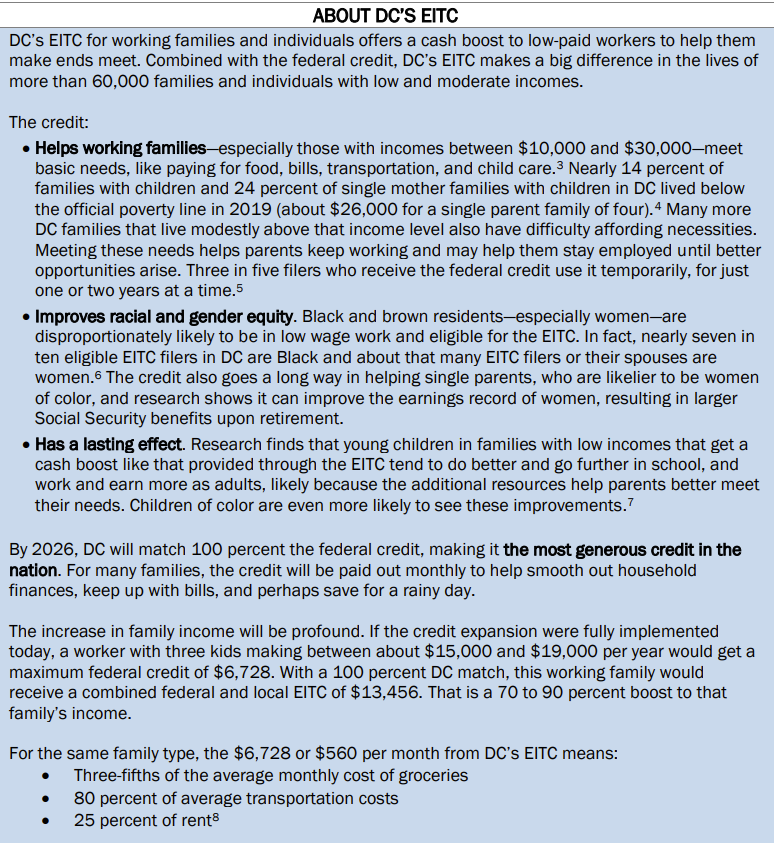

Dc S Earned Income Tax Credit The Most Generous In The Nation But Not The Most Inclusive

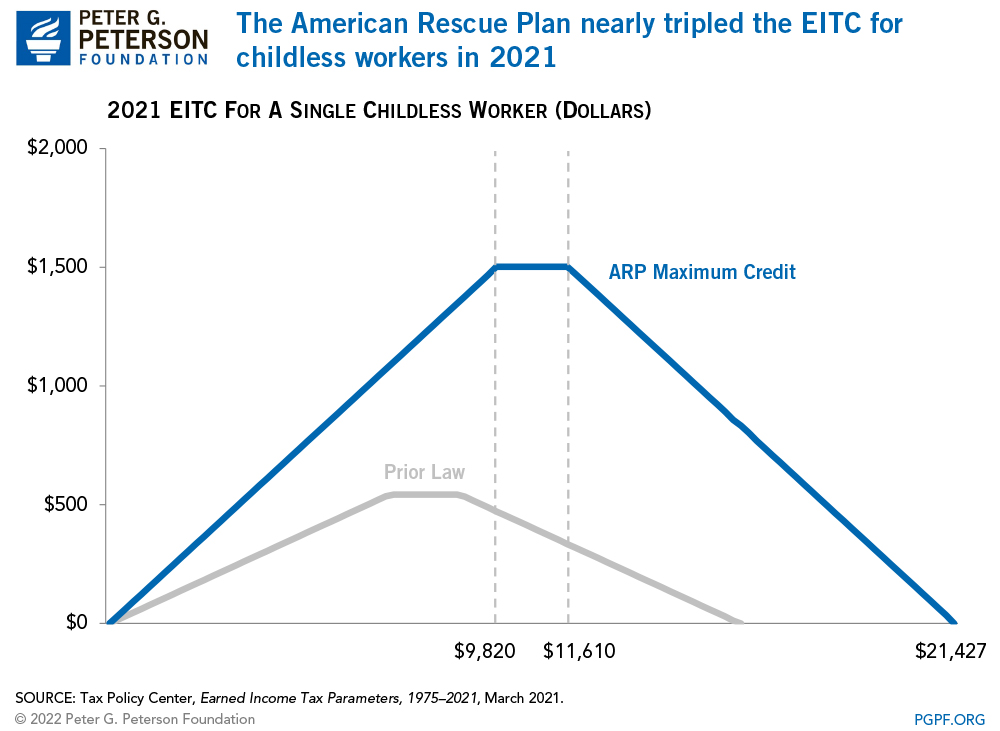

More Childless Adults Are Eligible For Earned Income Tax Credit Eitc

Summary Of Eitc Letters Notices H R Block

What Are Marriage Penalties And Bonuses Tax Policy Center

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

Earned Income Credit H R Block

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

Dc S Earned Income Tax Credit The Most Generous In The Nation But Not The Most Inclusive

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center